Since using Sombras FintechAsia, my finances have improved significantly. AI tools help me make smarter decisions, while blockchain ensures enhanced security. It’s transformed the way I manage financial transactions.

“Sombras FintechAsia is revolutionizing finance with advanced AI and blockchain tech. It offers innovative tools for smarter financial decisions, secure transactions, and seamless services, making it a game-changer for both businesses and individuals across Asia.”

Stay tuned as we explore how Sombras FintechAsia is shaping the future of finance, with its latest innovations and secure, accessible financial services for all.

What is the Role of Fintech in the Global Financial Landscape?

Fintech is revolutionizing the way financial services are delivered, especially in Asia. With rapid technological growth, fintech is enabling more people to access banking services through their smartphones and the Internet.

Sombras FintechAsia is at the forefront of this transformation, helping expand financial opportunities for the growing middle class in Asia.

By leveraging cutting-edge technologies, fintech tools like those offered by FintechAsia Sombras and FintechAsia Telekom make it easier for individuals and businesses to manage their finances.

Traditional banking systems are being disrupted by digital tools that offer more convenience, speed, and affordability, with companies like Sombras FintechAsia and FintechAsia Telekom leading the charge.

This rise of fintech enhances financial inclusion, giving underserved populations access to services that were once unavailable to them, further shaping the future of finance worldwide.

How is Sombras FintechAsia Leading the Digital Finance Revolution?

Sombras FintechAsia is at the forefront of the digital finance revolution, leveraging cutting-edge technologies like blockchain and artificial intelligence (AI) to reshape the financial landscape. Blockchain ensures secure, fast, and transparent transactions without the need for traditional banks.

AI-driven insights help users make smarter financial decisions by analyzing their spending habits and suggesting budgeting strategies. With mobile banking, Sombras is making it easier for individuals and businesses across Asia to access financial services anytime, anywhere.

This combination of innovation is transforming how people manage money, breaking down barriers, and promoting financial inclusion. By continuously advancing its technologies, Sombras is setting new standards for digital finance in Asia and beyond.

Read Also: 469-971-5890 – What You Need to Know Before Calling!

Why is Asia considered a leader in fintech?

Asia is considered a leader in fintech due to its rapid growth and innovation in the financial technology sector. The digital payments market in the region is expected to reach USD 1.2 trillion by 2025, showcasing its significant influence.

Around 19.6% of global fintech companies are based in Asia, reflecting its prominent role in shaping the industry. Countries like Singapore are at the forefront, fostering a thriving fintech ecosystem. The region’s adoption of new technologies and large population base are key drivers of its leadership in fintech.

What Key Services Does Sombras FintechAsia Offer to Transform Your Financial Experience?

Sombras FintechAsia offers a comprehensive range of services that make managing finances easier and more efficient. Here are some of the key services they provide to enhance your financial experience:

Digital Banking Solutions: Sombras FintechAsia offers mobile banking apps, digital wallets, and online account management for convenient, anytime access to your finances.

Investment Management: With automated portfolio management and real-time insights, Sombras helps users easily grow and manage their investments.

Payment Processing: Seamless payment solutions for both individuals and businesses, including online payments and point-of-sale systems, ensuring secure and efficient transactions.

Financial Planning Tools: Personalized budgeting, expense tracking, and goal-setting tools are designed to help users manage their finances and make informed decisions.

How Did Sombras FintechAsia Grow to Become a Leader in Fintech?

Company Background:

Sombras FintechAsia was founded with the vision to bridge the gap between traditional financial services and the rapidly changing digital world.

Established by a group of visionary entrepreneurs, Sombras sought to address the financial needs of the underbanked populations in Asia.

With its cutting-edge technologies and a customer-centric approach, the company has rapidly grown to become a leader in the fintech space.

Since its inception, Sombras has reached millions of users across Asia, offering a range of services from mobile wallets to AI-powered investment tools.

Its mission remains focused on providing affordable and accessible financial solutions, especially in regions with limited access to traditional banking infrastructure.

Sombras’ Impact on Asia’s Financial Ecosystem:

Sombras has had a profound impact on the Asian financial ecosystem by democratizing access to finance. The company’s platform allows users to access a variety of financial services, ranging from banking and lending to investments, all from their mobile phones.

By offering affordable and transparent services, Sombras has become a game-changer in the region’s financial landscape. The company’s emphasis on financial inclusion has allowed millions of people, especially in rural and underserved areas, to participate in the digital economy, previously restricted by traditional banking systems.

Read Also: Eric Mays Net Worth – 5 Ways Best Investments for Success!

What Technological Innovations Drive Sombras FintechAsia’s Success?

Blockchain Technology:

At the heart of Sombras’ technological infrastructure is blockchain technology, which ensures secure, transparent, and efficient financial transactions.

Blockchain allows Sombras to process payments faster and at lower costs compared to traditional financial systems. It also eliminates the need for intermediaries, reducing the risk of fraud and ensuring the integrity of transactions.

Sombras leverages blockchain to facilitate everything from cross-border payments to peer-to-peer lending, creating a more decentralized financial ecosystem.

This blockchain-based approach enhances trust between users and provides a level of transparency that traditional financial institutions struggle to match.

AI and Machine Learning Integration:

Sombras has integrated artificial intelligence (AI) and machine learning (ML) into its platform to offer personalized financial services.

AI-driven algorithms analyze vast amounts of data to provide users with tailored financial advice, helping them make informed decisions about budgeting, saving, and investing.

Machine learning models are also used to identify patterns in users’ financial behavior, allowing Sombras to provide customized loan offers, interest rates, and investment suggestions. This innovative use of AI and ML helps Sombras stay ahead of the competition while continuously improving user experiences.

What Are Sombras’ Core Financial Services and Features?

Sombras offers a wide range of innovative financial services designed to provide users with convenience, security, and effective money management. Some of its core offerings include:

Mobile Wallets and Digital Banking:

Sombras offers a convenient and secure mobile wallet that enables users to easily store and transfer money. The digital banking solution integrates essential banking services like opening accounts, transferring funds, paying bills, and accessing credit all from a smartphone.

With its user-friendly design, even those with limited tech knowledge can navigate the app with ease, ensuring financial management is accessible to everyone.

- Convenient way to store and transfer money

- Access to banking services, including accounts, transfers, and bill payments

- Budgeting and expense tracking tools for effective money management

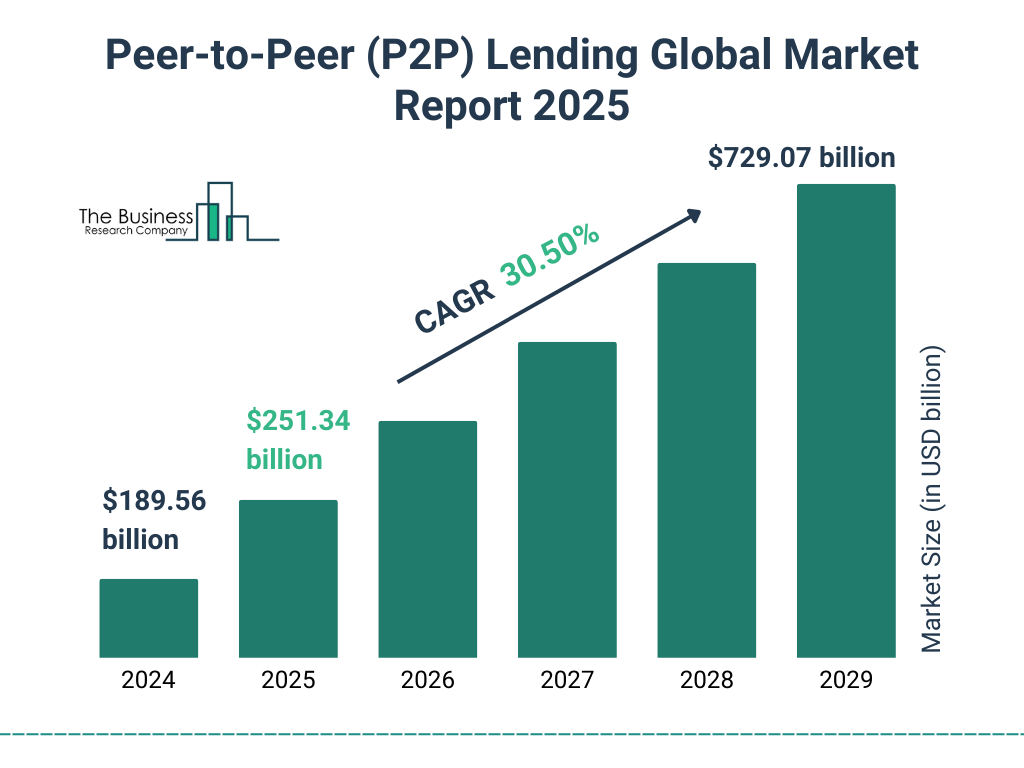

Peer-to-Peer Lending:

Sombras’ peer-to-peer lending platform directly connects borrowers with lenders, bypassing traditional banking intermediaries. This approach offers competitive loan rates for borrowers and attractive returns for lenders.

Advanced algorithms match borrowers with lenders based on risk profiles and financial needs, while robust risk management ensures investments are protected.

- Direct connection between borrowers and lenders

- Competitive loan rates and attractive returns for lenders

- Advanced algorithms and risk management features to ensure protection

Investment and Wealth Management Tools:

Sombras provides diverse investment opportunities, from stocks and bonds to mutual funds, catering to both experienced investors and newcomers.

AI-driven analytics help users stay informed about market trends and risks, empowering them to make smarter investment decisions.

Additionally, personalized portfolio management and retirement planning services guide users in achieving their long-term financial goals.

- Wide range of investment options, including stocks and bonds

- AI-powered analytics to guide investment decisions

- Personalized portfolio management and retirement planning assistance

Why is P2P lending important in emerging markets?

Peer-to-peer (P2P) lending is a game-changer in emerging markets where access to traditional banking services is often limited. Many individuals and small businesses in these regions struggle to secure financing from banks due to lack of credit history or collateral.

P2P platforms break down these barriers by directly connecting borrowers with lenders, offering a more inclusive financial solution. This fosters economic growth by providing much-needed capital to those who would otherwise be excluded.

Additionally, P2P lending helps promote financial independence, allowing borrowers to access loans at more affordable rates. Ultimately, it empowers individuals and businesses to thrive and contribute to the overall development of their economies.

How Does Financial Inclusion and Empowerment Drive Positive Change?

Sombras is making significant strides in promoting financial inclusion and empowerment, especially in underserved regions of Asia. By addressing key challenges such as the unbanked and underbanked population and fostering financial literacy, Sombras is empowering individuals to take control of their financial futures. Below are the key ways Sombras is driving positive change:

Addressing the Unbanked and Underbanked:

A significant portion of Asia’s population remains unbanked or underbanked, lacking access to traditional financial services. Sombras has taken a leading role in addressing this issue by providing digital financial services to individuals who have been excluded from the traditional banking system.

Through its mobile platform, Sombras enables users in remote areas to access essential financial services, such as savings accounts, loans, and insurance. This has helped millions of people achieve financial independence and improve their standard of living.

Promoting Digital Literacy and Financial Education:

Sombras understands the importance of financial education in empowering its users. The company has invested in digital literacy programs to help individuals better understand how to manage their finances, save for the future, and make informed investment decisions.

Sombras collaborates with local communities, NGOs, and educational institutions to promote financial literacy, ensuring that people from all walks of life can navigate the complexities of personal finance.

What is the goal of Fintech Asia Ltd?

Fintech Asia Ltd is dedicated to revolutionizing the financial services sector by investing in cutting-edge fintech companies. The company aims to support these businesses in expanding internationally, helping them grow and compete on a global scale.

By investing in innovation, Fintech Asia is driving change and disrupting traditional financial systems. Their focus is on empowering fintech companies to create new, more efficient financial solutions. Through these investments, Fintech Asia is shaping the future of finance across borders.

Security and Trust – How Does Sombras Ensure Security, Trust, and Compliance in FintechAsia?

User Data Protection and Privacy Measures:

Security is a top priority for Sombras, and the company employs advanced encryption and two-factor authentication to protect users’ data. Sombras adheres to global data protection standards, ensuring that personal and financial information remains secure.

The company also maintains transparency in its data privacy practices, providing users with full control over their personal information. Sombras’ commitment to data security has earned it the trust of millions of users across Asia.

Compliance with Local and International Regulations:

Sombras operates in multiple countries across Asia, each with its own set of regulations for fintech companies. To navigate this complex landscape, Sombras has established a dedicated compliance team that ensures the platform adheres to local laws and international financial regulations.

The company uses RegTech (regulatory technology) to automate compliance processes and ensure real-time updates on regulatory changes. This proactive approach to compliance helps Sombras maintain a strong reputation and avoid legal challenges.

Building Trust Among Users:

Trust is critical in the fintech industry, and Sombras has built its reputation by offering reliable, transparent, and user-friendly services. The company regularly receives positive feedback from its users, who appreciate its ease of use, security measures, and commitment to financial inclusion.

How Are AI and Blockchain Supporting SME Growth and Expansion?

Sombras for Small and Medium Enterprises (SMEs):

Sombras plays a crucial role in helping small and medium-sized enterprises (SMEs) access the financial tools they need to grow. The company offers tailored financial solutions, including business loans, cross-border payments, and cash flow management tools.

AI-powered analytics help businesses track performance, manage risks, and optimize operations. Sombras also provides business intelligence tools that allow SMEs to make data-driven decisions and stay competitive in the global marketplace.

Business Expansion and Cross-Border Transactions:

For businesses operating in multiple countries, Sombras offers cross-border payment solutions that simplify international transactions. Blockchain technology ensures that payments are secure, transparent, and processed quickly, making it easier for businesses to expand into new markets.

User Experience – How Does Sombras FintechAsia Stand Out?

Design and Usability of the Platform:

Sombras has invested heavily in the design and user experience (UX) of its platform. The app is intuitive, with a clean and simple interface that allows users to navigate through various financial services with ease.

Sombras also ensures accessibility by offering multi-language support and adapting the app to different devices and operating systems. This user-first approach has contributed significantly to its widespread adoption.

Customer Support and Community Engagement:

Sombras provides exceptional customer support, offering assistance through multiple channels, including live chat, email, and phone support. The company also maintains an active presence on social media, engaging with users and addressing their concerns in real-time.

The Sombras community is vibrant and supportive, with regular webinars, forums, and educational content designed to help users maximize the benefits of the platform.

Can Sombras’ Partnerships Help Grow Your Business?

Sombras’ strategic partnerships with banks, financial institutions, and fintech companies play a crucial role in driving its growth and innovation. These collaborations enhance the range of financial products and services offered, while also positioning Sombras at the forefront of the fintech industry. Here’s how these partnerships contribute to the company’s success:

- Strategic Partnerships with Banks and Financial Institutions: Sombras has formed alliances with leading banks and financial institutions across Asia, enabling access to a broader selection of financial services for its users.

- Fintech Collaborations and Networking: By collaborating with fintech startups and tech companies, Sombras stays at the forefront of industry advancements, continuously improving its platform and services.

Challenges and Opportunities in the Asian Fintech Landscape – Discover Fintech Insights!

Navigating Regulatory Hurdles:

The fintech landscape in Asia is characterized by diverse regulatory environments, which can pose challenges for companies like Sombras. However, Sombras has successfully navigated these challenges by staying compliant and adapting to local laws and regulations.

Competitive Landscape:

The fintech industry in Asia is highly competitive, with major players like Paytm, Alipay, and Grab dominating the market. However, Sombras stands out with its focus on financial inclusion, innovative use of blockchain, and AI-powered tools.

Future Prospects – What’s Next for Sombras FintechAsia?

Sombras is constantly innovating to provide its users with cutting-edge financial services. As the company continues to grow, its upcoming features and long-term impact will significantly shape the Asian economy.

Upcoming Features and Technological Innovations:

Sombras is committed to staying ahead of the curve by continually improving its services to meet the changing demands of its users. The company is working on integrating advanced AI-powered financial planning tools, which will make it easier for individuals and businesses to manage their finances.

Additionally, Sombras is expanding its blockchain-based services to accommodate new types of transactions, providing a more secure and efficient way to conduct financial operations.

- AI-driven financial planning tools for smarter decision-making.

- Blockchain technology expansion to support diverse transactions.

- Improved services aimed at meeting evolving user needs.

Sombras’ Long-Term Impact on the Asian Economy:

As Sombras continues to grow, its influence on the Asian economy will be significant. The company’s mission to provide accessible financial services is to help millions of people across the region.

By offering these services, Sombras is contributing to economic development, creating job opportunities, and empowering both individuals and businesses to thrive in the global market.

- Providing accessible financial services to underserved populations.

- Promoting economic development and job creation in Asia.

- Empowering individuals and businesses with financial tools for growth.

FAQ’s

What is Sombras FintechAsia?

Sombras FintechAsia is a fintech company that provides digital financial services, including mobile wallets, peer-to-peer lending, and investment tools, to users across Asia.

How does Sombras use blockchain technology?

Sombras uses blockchain technology to facilitate secure, transparent, and cost-efficient financial transactions, eliminating the need for intermediaries and reducing fraud.

Is Sombras safe to use?

Yes, Sombras employs advanced encryption and two-factor authentication to ensure the security of user data and transactions.

How does Sombras help small businesses?

Sombras provides small businesses with access to loans, cross-border payments, and AI-powered business tools to help them grow and manage their operations.

How has Singapore contributed to fintech development?

Singapore has become one of Asia’s top fintech hubs, playing a key role in fostering innovation and investment in the financial technology sector.

What is Sombras FintechAsia’s strategy for growth?

Sombras FintechAsia focuses on identifying target companies or acquisitions in the fintech sector to drive growth, leveraging its experience in finance and business across Asia and beyond.

Conclusion

Sombras FintechAsia is revolutionizing the financial landscape in Asia by providing innovative, secure, and inclusive financial services. blockchain and AI to mobile wallets and P2P lending, Sombras is at the forefront of the fintech revolution.

With its commitment to financial inclusion, user security, and technological innovation, Sombras is shaping the future of finance in Asia and beyond.

Read Also: