Fintechzoom.com Bitcoin USD offers real-time price tracking and comprehensive market analysis for cryptocurrency enthusiasts. Its user-friendly design makes it easy to navigate, helping investors stay informed about Bitcoin’s fluctuations. With valuable insights and data, Fintechzoom.com is an essential tool for anyone looking to succeed in the crypto market.

Stay tuned with us as we continue to explore Fintechzoom.com Bitcoin USD! We’ll provide more updates, tips, and strategies to help you navigate the exciting world of cryptocurrency investing.

What is Fintechzoom.com used for?

Fintechzoom.com is a comprehensive online platform that serves as a vital resource for financial technology enthusiasts and investors. It provides real-time updates on cryptocurrency prices, particularly Bitcoin, along with news and analysis of market trends.

Users can access a wide range of content, including insights on stock markets, fintech innovations, and investment strategies. The platform aims to bridge the gap between traditional finance and modern technology, making it invaluable for both seasoned investors and newcomers.

Additionally, it features expert opinions and detailed reviews of financial products, helping users make informed decisions in the rapidly evolving fintech landscape. Overall, Fintechzoom.com Bitcoin USD is designed to enhance users’ understanding of financial markets and empower them to navigate the digital financial ecosystem effectively.

How does Fintechzoom.com provide real-time Bitcoin price updates?

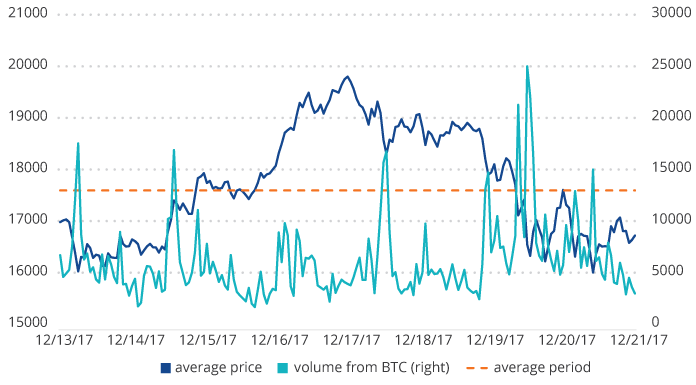

FintechZoom.com provides real-time Bitcoin price updates by collecting data from various cryptocurrency exchanges. The platform uses advanced algorithms to process this aggregated data, ensuring accuracy and reliability.

This system allows users to access the latest Bitcoin price movements without delay. The data is presented in a clear and easy-to-understand format, enabling traders to make informed decisions quickly.

By continuously monitoring multiple exchanges, FintechZoom.com ensures its updates reflect the current market conditions. This feature makes it a trusted tool for anyone tracking Bitcoin prices or engaging in cryptocurrency trading.

Why is Bitcoin so volatile compared to other currencies?

Bitcoin’s volatility is primarily driven by several key factors that differentiate it from traditional currencies. Firstly, Bitcoin has a limited supply, capped at 21 million coins, which creates significant price fluctuations when demand surges or drops sharply. This scarcity can lead to rapid price increases during bullish market phases, but also steep declines when sentiment shifts.

Secondly, speculative trading plays a major role; many investors buy and sell Bitcoin based on short-term price movements rather than its fundamental value. This behavior is often fueled by fear and greed, leading to panic buying or selling which exacerbates volatility.

Additionally, Bitcoin operates in a decentralized environment, meaning its value is determined solely by market forces without governmental backing. This lack of regulation contributes to its susceptibility to external factors like news events and regulatory changes, which can provoke sudden price swings.

Lastly, the market for Bitcoin is still relatively immature compared to traditional assets, making it more vulnerable to large trades from “whales” (individuals or entities holding significant amounts of Bitcoin). These dynamics collectively ensure that Bitcoin remains one of the most volatile assets in the financial world.

What factors influence Bitcoin price movements?

Several key factors influence Bitcoin’s price movements, making it one of the most volatile assets in the financial market. Understanding these factors can help investors navigate the complexities of cryptocurrency trading more effectively.

1. Market Demand and Supply:

The fundamental economic principle of supply and demand plays a crucial role in determining Bitcoin’s price. Bitcoin has a capped supply of 21 million coins, which creates scarcity. As more people become interested in owning Bitcoin, demand increases, leading to higher prices.

Conversely, if demand decreases or there is a sudden influx of coins being sold, prices can drop sharply. This limited supply mechanism is similar to commodities like gold, where scarcity can drive value.

2. Investor Sentiment:

Investor sentiment significantly impacts Bitcoin’s price fluctuations. Market psychology, driven by emotions such as fear and greed, can lead to rapid buying or selling. Positive news or endorsements can create bullish sentiment, prompting more investors to buy in anticipation of rising prices.

On the other hand, negative news such as regulatory crackdowns or security breaches can trigger panic selling, causing prices to plummet. Tools like the Fear and Greed Index are often used to gauge market sentiment and predict potential price movements.

3. Technological Advancements:

Technological developments within the cryptocurrency space can also affect Bitcoin’s price. Innovations such as upgrades to the Bitcoin network (e.g., improvements in transaction speed or security) can enhance its utility and attractiveness to investors.

Additionally, advancements in blockchain technology or the introduction of new applications for Bitcoin can lead to increased adoption and demand, thereby driving up its price.

4. Government Regulations:

Government policies and regulations surrounding cryptocurrencies can have a profound impact on Bitcoin’s price. In countries where cryptocurrencies are embraced, increased acceptance can lead to higher demand and prices.

Conversely, strict regulations or outright bans in certain regions can create uncertainty and fear among investors, leading to price declines. Regulatory news often triggers immediate reactions in the market, highlighting the sensitivity of Bitcoin’s price to external legal factors.

5. Global Economic Conditions

Broader economic conditions also influence Bitcoin’s price movements. Factors such as inflation rates, currency devaluation, and geopolitical events can drive investors toward Bitcoin as a perceived haven or alternative investment.

For instance, during times of economic instability or high inflation, some investors may turn to Bitcoin as a hedge against traditional fiat currencies losing value, which can increase demand and push prices higher.

Bitcoin’s price is influenced by a complex interplay of market dynamics, investor behavior, technological progress, regulatory frameworks, and global economic conditions. Understanding these factors is essential for anyone looking to invest in or trade Bitcoin effectively.

How do geopolitical events affect Bitcoin prices?

Geopolitical events significantly influence Bitcoin prices, often resulting in increased volatility within the cryptocurrency market. During times of conflict, such as wars or political unrest, investors tend to seek safe-haven assets to protect their investments.

In this context, Fintechzoom.com Bitcoin USD has become increasingly viewed as an alternative haven, akin to gold. This shift in perception can lead to heightened demand for Bitcoin, driving its price upward.

For instance, during recent geopolitical tensions in the Middle East, Bitcoin demonstrated resilience and even price increases as investors sought ways to hedge against instability.

However, the initial reaction to geopolitical shocks can also trigger sharp declines in Bitcoin’s value due to panic selling or market uncertainty.

Additionally, the interconnectedness of global markets means that factors like rising oil prices or trade sanctions can further impact Bitcoin’s price movements.

As investors react to these external influences, Bitcoin’s volatility tends to reflect broader market sentiments. Overall, while Bitcoin may serve as a hedge during geopolitical crises, its response can vary widely depending on the specific nature and context of the unfolding events.

What is the impact of government regulations on Bitcoin prices?

Government regulations significantly shape the dynamics of Bitcoin prices, creating both opportunities and challenges for investors.

Positive Regulatory Developments:

When favorable regulations are introduced, they can enhance investor confidence in Bitcoin. For example, the approval of Bitcoin-linked ETFs has historically led to price surges, such as the SEC’s approval in October 2021, which contributed to Bitcoin reaching nearly $69,000.

Restrictive Policies:

Conversely, negative regulations can instill fear and uncertainty among investors, resulting in sell-offs. A notable instance occurred in September 2021 when China’s crackdown on cryptocurrency trading caused Bitcoin’s price to plummet from around $51,000 to approximately $41,000 within weeks.

Global Regulatory Landscape:

The regulatory environment is diverse across countries. For instance, Japan recognizes Bitcoin as a legal tender, while China enforces strict bans. These contrasting approaches can lead to price discrepancies across markets and impact trading volumes.

Anticipation of Regulatory Changes:

Investors often react to news about potential regulations before they are officially implemented. This anticipation can lead to market volatility characterized by preemptive buying or selling as traders speculate on future outcomes.

Long-Term Implications:

In the long run, ongoing regulatory clarity can foster a more stable market environment. Clear and supportive frameworks may encourage institutional adoption, positively influencing Bitcoin’s price.

In summary, government regulations play a crucial role in shaping Bitcoin’s market dynamics, significantly affecting both investor behavior and price movements. Understanding these regulatory impacts is essential for navigating the evolving landscape of cryptocurrency investment.

Can technological advancements influence Bitcoin prices?

Yes, technological advancements can significantly influence Bitcoin prices by enhancing its functionality and appeal. Innovations in blockchain technology, such as improvements in transaction speed and efficiency, can make Bitcoin more user-friendly and practical for everyday transactions.

For example, developments like the Lightning Network aim to facilitate faster and cheaper transactions, which can increase Bitcoin’s utility and attract more users.

Additionally, advancements in security measures bolster investor confidence by reducing the risk of hacks and fraud. As Bitcoin becomes more secure and reliable, it becomes a more attractive investment option.

Furthermore, scalability solutions that allow the Bitcoin network to handle a larger volume of transactions can enhance its viability as a global payment system.

Overall, these technological improvements not only make Bitcoin more accessible but also contribute to its long-term value appreciation by drawing in new investors and fostering greater adoption.

What are the benefits of using Fintechzoom.com for Bitcoin price analysis?

1. Real-Time Price Updates:

Fintechzoom.com provides continuous, real-time updates on Bitcoin’s price, allowing users to monitor fluctuations as they happen. This feature is essential for traders who need to make quick decisions based on the latest market conditions. With live data at their fingertips, investors can capitalize on opportunities and react promptly to market changes.

2. Detailed Market Trends and Analysis:

The platform offers in-depth analysis of market trends, utilizing both fundamental and technical analysis methods. Users can access historical data, price patterns, and market indicators that help them understand the broader context of Bitcoin’s price movements. This comprehensive insight enables investors to make informed predictions about future price trends.

3. News on Cryptocurrency Developments:

Fintechzoom.com keeps users updated with the latest news related to Bitcoin and the cryptocurrency market. This includes information on regulatory changes, technological advancements, and significant events that could impact Bitcoin’s value. Staying informed about these developments is crucial for making strategic investment decisions.

4. Tools for Tracking Bitcoin Across Different Exchanges:

The platform provides tools that allow users to track Bitcoin prices across various exchanges. This feature helps investors identify the best trading opportunities by comparing prices and fees on different platforms. By having access to this information, users can optimize their trading strategies and maximize their returns.

5. User-Friendly Interface:

Fintechzoom.com is designed with a user-friendly interface that makes it accessible to both seasoned traders and newcomers to cryptocurrency investing. The intuitive layout allows users to navigate easily through different sections, ensuring they can find the information they need without hassle.

6. Educational Resources:

For those new to Bitcoin or cryptocurrency trading, Fintechzoom.com offers educational content that breaks down complex concepts into understandable terms. This resource helps users build their knowledge base, making them more confident in trading decisions.

In summary, Fintechzoom.com serves as a comprehensive resource for anyone interested in Bitcoin price analysis. Its real-time updates, detailed market insights, news coverage, tracking tools, user-friendly design, and educational resources collectively empower investors to navigate the cryptocurrency landscape effectively and make informed decisions.

How does Fintechzoom.com track Bitcoin prices across different exchanges?

Fintechzoom.com effectively tracks Bitcoin prices across different exchanges by utilizing Application Programming Interfaces (APIs) to gather live data from major cryptocurrency exchanges.

This method allows the platform to continuously pull and update Bitcoin price information in real time, ensuring users have access to the most current market data.

By aggregating prices from various sources, Fintechzoom.com provides a comprehensive view of Bitcoin’s value across different platforms, enabling users to make informed trading decisions.

Additionally, the platform features live charts that display Bitcoin’s performance minute-by-minute, along with historical data for trend analysis.

This capability helps users identify patterns and make strategic choices based on past performance. Overall, Fintechzoom.com’s approach to tracking Bitcoin prices enhances user experience by offering accurate and timely information necessary for effective trading in the dynamic cryptocurrency market.

What investment strategies are recommended for Bitcoin on Fintechzoom.com?

Fintechzoom.com recommends several effective investment strategies for Bitcoin that cater to different investor preferences and risk tolerances:

Long-Term Holding (HODLing):

This strategy involves purchasing Bitcoin and holding onto it for an extended period, regardless of market fluctuations. Investors who adopt this approach believe in Bitcoin’s long-term growth potential, often ignoring short-term volatility. Historically, many early investors have benefited from this method as Bitcoin’s value has appreciated over time.

Dollar-Cost Averaging (DCA):

DCA is a strategy where investors allocate a fixed amount of money to buy Bitcoin at regular intervals, rather than investing a lump sum all at once. This approach helps mitigate the risks associated with market timing, allowing investors to gradually build their positions while averaging out the purchase price over time. It enables them to take advantage of both high and low market prices.

Swing Trading:

This strategy focuses on capitalizing on short- to medium-term price movements in Bitcoin. Swing traders aim to buy low and sell high within days or weeks, leveraging market volatility for profit. This method requires a solid understanding of technical analysis and market trends to identify optimal entry and exit points.

Portfolio Diversification:

To reduce risk, investors are encouraged to diversify their portfolios by including a mix of assets such as Bitcoin, stocks, and real estate. A well-balanced portfolio can help cushion against the inherent volatility of Bitcoin, ensuring that losses in one area may be offset by gains in another.

Buying the Dip:

This strategy involves purchasing Bitcoin when its price has significantly dropped, with the expectation that it will rebound over time. While this can be a profitable approach, it carries risks since future price movements are unpredictable, and further declines may occur after the purchase.

Staying Informed:

Fintechzoom.com emphasizes the importance of keeping up with market news and developments that could impact Bitcoin prices. By staying informed about regulatory changes, technological advancements, and broader economic conditions, investors can make more strategic decisions regarding their investments.

By employing these strategies, investors can navigate the complexities of the Bitcoin market more effectively while maximizing their potential returns and minimizing risks.

What is long-term holding (HoDLing) in Bitcoin investments?

Long-term holding, often referred to as “HoDLing,” is an investment strategy where individuals purchase Bitcoin and retain it for an extended period, typically years, regardless of market volatility.

This approach is rooted in the belief that Bitcoin will appreciate significantly over time, despite experiencing short-term price fluctuations.

The term “HODL” originated from a misspelled online post in 2013 and has since become a rallying cry for Bitcoin enthusiasts who advocate patience in the face of market turbulence.

Investors who adopt this strategy often ignore daily price changes and focus on the long-term potential of Bitcoin as a digital asset and store of value.

By holding onto their investments through market ups and downs, they aim to benefit from Bitcoin’s historical trend of increasing value over time.

This strategy has proven successful for many early adopters, who have seen substantial returns on their investments as Bitcoin’s price has risen dramatically since its inception.

What is Dollar Cost Averaging (DCA), and how does it work for Bitcoin?

Dollar Cost Averaging (DCA) is an investment strategy that involves consistently investing a fixed amount of money into Bitcoin at regular intervals, regardless of its price at the time of purchase.

This approach helps mitigate the impact of market volatility, allowing investors to accumulate Bitcoin over time without the stress of trying to time the market perfectly.

By spreading out investments, DCA reduces the risk associated with making a large lump-sum investment when prices may be high.

For example, if an investor decides to invest $100 in Bitcoin every month, they will buy more Bitcoin when prices are low and less when prices are high.

This strategy effectively averages out the purchase price over time, potentially lowering the overall cost basis of their investment. DCA is particularly appealing in the volatile cryptocurrency market, where prices can fluctuate dramatically within short periods.

Moreover, DCA encourages a disciplined investment approach, helping investors avoid emotional decision-making that can lead to buying high and selling low.

It is a long-term strategy designed for those who believe in Bitcoin’s potential for future growth while minimizing the risks associated with short-term price swings. Overall, DCA is a practical way for both new and experienced investors to build their Bitcoin holdings steadily and confidently.

How can swing trading be used for Bitcoin investments?

Swing trading is a popular investment strategy that capitalizes on the volatility of Bitcoin’s price within short to medium timeframes, typically ranging from a few days to a few weeks. This approach involves buying Bitcoin during price dips and selling it during price surges, allowing traders to profit from the natural fluctuations in the market.

How Swing Trading Works:

Swing traders aim to capture gains by identifying and exploiting price swings. They typically use technical analysis, including tools such as candlestick charts, support and resistance levels, and various indicators, to determine optimal entry and exit points. For example, a trader might buy Bitcoin when its price hits a known support level and sell when it reaches a resistance level or when a specific target price is achieved.

Key Strategies in Swing Trading:

- Technical Analysis: Most swing traders rely heavily on technical analysis to make informed decisions. This includes analyzing historical price movements and identifying patterns that suggest future behavior.

- Fibonacci Retracement: This strategy uses horizontal lines to indicate potential support and resistance levels based on the Fibonacci sequence. Traders can enter positions at these critical levels during price retracements.

- Support and Resistance: Identifying these levels is crucial for swing trading. A support level indicates where prices tend to stop falling, while a resistance level shows where prices tend to stop rising.

Advantages of Swing Trading:

- Flexibility: Swing trading allows for more flexibility than day trading, as traders do not need to monitor the market continuously throughout the day.

- Potential for Profit: By capturing short-term price movements, traders can realize profits more quickly than long-term investment strategies.

- Less Time Commitment: This strategy suits those with busy schedules since it requires less frequent trading than day trading.

Risks Involved:

While swing trading can be profitable, it also carries risks. Market conditions can change rapidly, leading to potential losses if trades are not managed carefully. Additionally, swing traders are exposed to overnight and weekend risks where significant price changes can occur outside regular trading hours.

In summary, swing trading offers a dynamic way to invest in Bitcoin by taking advantage of its price volatility. With careful analysis and strategic planning, traders can effectively navigate the market and enhance their investment returns.

What does “Buy the Dip” mean in cryptocurrency trading?

“Buy the Dip” is a popular investment strategy in cryptocurrency trading that involves purchasing assets like Bitcoin when their prices have significantly dropped.

The underlying assumption of this strategy is that the price will eventually rebound, allowing investors to profit from the recovery by acquiring the asset at a lower price during a market downturn.

How “Buy the Dip” Works:

The concept of buying the dip is straightforward: when traders notice a decline in the price of Bitcoin, they view it as an opportunity to buy at a bargain. This approach is based on the belief that the dip is temporary and that prices will rise again in the future. Historically, this strategy has been employed by both novice and experienced traders across various markets, including stocks and cryptocurrencies.

Key Considerations:

- Market Timing: Successful dip buying requires careful timing. Traders need to identify when a price drop occurs and assess whether it represents a genuine opportunity or if it signals further declines. This often involves analyzing market trends and price movements to determine potential reversal points.

- Fundamental Analysis: Investors should also consider the fundamental value of Bitcoin or any other cryptocurrency before buying the dip. If the asset’s fundamentals remain strong, the likelihood of a price recovery increases. Conversely, if negative news or market sentiment persists, prices may continue to fall.

- Risk Management: Effective risk management is crucial when implementing this strategy. Traders should set budgets for their investments and be prepared for potential losses if prices do not recover as anticipated. It’s essential to only invest what one can afford to lose in such a volatile market.

- Patience and Discipline: Buying the dip is not a guaranteed way to make profits quickly; it requires patience and discipline. Market recoveries can take time, and investors must be willing to wait for their investments to yield returns.

- Market Sentiment: The effectiveness of buying the dip can also be influenced by broader market sentiment, including news events and regulatory developments that may impact cryptocurrency prices. Staying informed about these factors can help traders make educated decisions.

Risks Involved:

While buying the dip can be profitable, it carries inherent risks. There is no guarantee that prices will recover after a dip; various unpredictable factors can influence market movements. Additionally, if an investor buys into a declining asset without proper analysis, they may end up exacerbating their losses.

“Buy the Dip” is a strategic approach in cryptocurrency trading that allows investors to capitalize on temporary price declines with the expectation of future gains. By employing sound analysis, effective risk management, and maintaining patience, traders can enhance their chances of success while navigating the volatility of the crypto market.

How can stop-loss orders help in managing Bitcoin investment risks?

Stop-loss orders are essential tools in cryptocurrency trading, particularly for managing risks associated with Bitcoin investments. A stop-loss order is a pre-set instruction to sell Bitcoin automatically when its price falls to a predetermined level. This mechanism is designed to limit an investor’s losses and protect their capital in a highly volatile market.

How Stop-Loss Orders Work:

When an investor buys Bitcoin, they can set a stop-loss order at a specific price point below the purchase price. For example, if a trader buys Bitcoin at $40,000 and sets a stop-loss order at $38,000, the order will automatically execute and sell the Bitcoin if its price drops to $38,000. This action caps the potential loss at $2,000, allowing the trader to exit the position before losses escalate further.

Benefits of Using Stop-Loss Orders:

- Limiting Losses: The primary advantage of stop-loss orders is that they help investors limit their losses by defining an exit strategy in advance. This is particularly important in the cryptocurrency market, where prices can fluctuate dramatically in short periods.

- Automated Selling: Stop-loss orders eliminate the need for constant monitoring of market prices. Once set, these orders automatically execute when the specified price is reached, reducing stress and allowing investors to focus on other activities.

- Risk Management: By capping potential losses, stop-loss orders serve as a crucial risk management tool. They enable traders to exit positions before their investments decline significantly during market downturns.

- Emotional Control: Stop-loss orders help mitigate emotional decision-making during trading. Investors are less likely to panic sell or hold onto losing positions if they have predetermined exit points in place.

Considerations and Risks:

While stop-loss orders are beneficial, they are not without risks:

- Temporary Price Fluctuations: A common disadvantage is that stop-loss orders can be triggered by short-term price fluctuations or “whipsaws.” For instance, if Bitcoin’s price briefly dips below the stop-loss level but then quickly rebounds, the investor may end up selling at a loss unnecessarily.

- Market Gaps: In volatile markets, prices can gap down past the stop-loss level, resulting in execution at a significantly lower price than anticipated. For example, if Bitcoin drops from $40,000 to $35,000 overnight due to negative news, the stop-loss order would trigger at $35,000 rather than $38,000.

- Setting Appropriate Levels: Determining the right level for stop-loss orders requires careful analysis. Setting them too close to the purchase price may lead to premature selling due to normal market volatility. Conversely, setting them too far away could expose investors to larger losses than they are comfortable with.

Advanced Strategies:

Experienced traders often use advanced strategies with stop-loss orders:

- Strategic Placement: Traders analyze historical price data and key support levels to place their stop-loss orders effectively. For example, placing a stop-loss just below a known support level can prevent unnecessary sell-offs while still allowing for minor fluctuations.

- Multiple Stop-Loss Orders: Some traders implement multiple stop-loss levels for a single position. This approach involves setting different stop-loss prices for portions of their holdings to manage risk more effectively across various market scenarios.

stop-loss orders are vital for managing risks in Bitcoin investments by providing a structured approach to limiting losses and automating sell decisions during market volatility. While they offer significant advantages in protecting capital and reducing emotional stress, investors must carefully consider their placement and be aware of potential pitfalls associated with this trading strategy.

What is Bitcoin’s current price trend in 2024?

As of January 16, 2025, Bitcoin’s price trend in 2024 has been characterized by significant fluctuations influenced by various factors, including market recovery, increased institutional adoption, and global economic conditions. Throughout 2024, Bitcoin experienced notable price movements, reaching an all-time high of approximately $100,000 before settling around $99,200.

Key Influencing Factors:

- Market Recovery: Following a period of volatility in previous years, the cryptocurrency market began to stabilize in 2024. This recovery was marked by renewed investor confidence and a resurgence in trading activity.

- Institutional Adoption: Increased interest from institutional investors played a crucial role in driving Bitcoin’s price upward. Many institutions began to allocate funds to Bitcoin as part of their investment strategies, further legitimizing the cryptocurrency as a viable asset class.

- Global Economic Conditions: Economic factors such as inflation rates and monetary policy changes also impacted Bitcoin’s price. For instance, the U.S. Federal Reserve’s decisions regarding interest rates influenced market sentiment and investor behavior toward cryptocurrencies.

Price Movements:

- In early 2024, Bitcoin’s price surged following the approval of Bitcoin Spot ETFs, leading to a rapid increase in demand and pushing prices above $60,000.

- By mid-2024, Bitcoin reached new highs during significant market events, including its fourth halving event on April 19, which reduced mining rewards and contributed to upward price pressure.

- The latter part of 2024 saw Bitcoin hitting another all-time high of around $76,999 after the U.S. presidential election results favored pro-crypto policies.

Current Status:

As of the latest data on January 16, 2025, Bitcoin is priced at approximately $99,211.80 with a slight decline from its recent peak. Analysts suggest that if Bitcoin maintains support around the $100,000 level.

What are institutional investors’ predictions for Bitcoin prices in 2024?

Institutional investors are optimistic about Bitcoin’s price in 2024, predicting steady growth due to increased adoption and technological advancements. Some experts, like Max Keiser, believe Bitcoin could reach $200,000 by the end of the year.

Analysts from Bernstein also forecast a similar surge, attributing it to strong inflows into Bitcoin exchange-traded funds (ETFs).

The approval of these ETFs is expected to attract more institutional investment, further solidifying Bitcoin’s status as a mainstream asset. Overall, the sentiment is bullish, with many anticipating that Bitcoin will continue to gain traction among both retail and institutional investors.

What Are the Key Insights from Bitcoin Price Analysis on January 16, 2025?

As of January 16, 2025, Bitcoin is trading at approximately $99,308.80. This reflects a slight increase from earlier in the day, where it fluctuated between a low of $96,497 and a high of $100,725. The price represents a 2.37% increase from the previous close.

Price Volatility in 2024:

Throughout 2024, Bitcoin experienced significant volatility:

- Q1: An impressive increase of 42.7%.

- Q2: A decline of 11.3%.

- Q3: Further drop by 13%.

This volatility has left traders anticipating a potential recovery in Q4.

Factors Influencing Price Changes:

The recent price movements are influenced by several key factors:

- Institutional Adoption: Major investors like BlackRock and MicroStrategy are optimistic about Bitcoin’s future, with predictions suggesting it could reach $80,000 by the end of 2024.

- Market Trends: The overall upward trend began in October when Bitcoin was around $60,000, driven by expectations of future growth in the cryptocurrency market.

Read Also: Nothing2Hide Net Gaming – Top 5 Best Features for Gamers!

What Is the Future Outlook for Bitcoin Prices?

The future of Bitcoin prices is influenced by several key factors, including market adoption, regulatory changes, and global economic trends.

Institutional Adoption:

Growing interest from institutional investors, such as Tesla’s significant investments in Bitcoin, is enhancing market stability and liquidity. As more financial institutions engage with Bitcoin, demand may increase, potentially driving prices higher.

Regulatory Developments:

Regulation is crucial for Bitcoin’s future. Governments are evaluating how to approach cryptocurrency regulation. Stricter rules could negatively impact prices, while supportive regulations may attract new investors. The outcomes of discussions in major markets like the U.S., Europe, and China will be significant.

Global Economic Uncertainty:

Bitcoin is increasingly seen as “digital gold,” serving as a haven during economic turmoil. Investors often turn to Bitcoin during crises, but improved confidence in traditional currencies could lead to price declines.

Bitcoin’s price trajectory will depend on institutional engagement, regulatory clarity, and economic conditions. Investors should stay informed about these evolving factors.

FAQ’s

How does global economic uncertainty impact Bitcoin prices?

During periods of economic uncertainty, Bitcoin often attracts investors as a hedge against inflation and currency devaluation. This increased demand can drive up Bitcoin prices.

What is the highest price Bitcoin has ever reached?

Bitcoin reached an all-time high of approximately $69,000 in November 2021. This peak was driven by increased adoption, market speculation, and institutional interest.

What was Bitcoin’s lowest price?

Bitcoin’s lowest recorded price was less than $0.01 when it was first introduced in 2009. Since then, its value has grown exponentially, making it one of the most valuable assets in the financial market.

Why is Bitcoin considered a “digital gold”?

Bitcoin is increasingly viewed as a store of value during economic uncertainty, similar to gold. Investors often turn to Bitcoin as a hedge against inflation and currency devaluation during crises.

What should investors consider about Bitcoin’s volatility?

Bitcoin’s price is historically volatile, which presents both opportunities and risks. Investors should stay informed and exercise caution when navigating this dynamic market.

How can platforms like Fintechzoom assist investors?

Fintechzoom provides real-time updates and analytical insights that help both novice and experienced investors stay informed about price movements and market dynamics, aiding them in making informed investment decisions.

Conclusion

Fintechzoom.com Bitcoin USD serves as an essential resource for anyone navigating the ever-changing landscape of cryptocurrency. With its real-time updates and comprehensive analysis, the platform empowers both novice and seasoned investors to make informed decisions.

By bridging the gap between traditional finance and modern technology, Fintechzoom.com provides critical insights into Bitcoin prices and market trends.

Whether you’re tracking Bitcoin’s value or exploring new investment strategies, Fintechzoom.com is your go-to source for staying ahead in the world of digital currency.

Read Also: